Each policy will pay 25000 for the loss. Company A carries 13 of the total coverage 20k 40k 60k.

Fundamental Principles In Insurance Ppt Video Online Download

There is no reason for a homeowner not to insure.

. If the insured has other insurance against liability covered by this policy the company shall not be liable for a greater proportion of such loss. The pro rata liability clause is designed to protect the principle of The two major actions required for a policyholder to comply with the Reinstatement Clause are Life insurance policies will normally pay for losses arising from. Sources of insurability information written by an insurer-insurance history-motor vehicle records-interviews with the applicants neighbors and friends-inspection of property-application form.

A pro rata clause is a clause in an insurance policy which states that each insurer providing coverage for an asset will pay out claims for that asset in proportion to the coverage percentage for the asset that it is providing. The introduction of prora-tion provisions and restricted use exclusions became a common. Provision in many property insurance policies that spreads the obligation to pay a claim among various insurers covering that claim in proportion to the insurance each has written on the property.

Pro rata clauses keep claims payouts fair in cases where multiple insurers cover the same asset. The pro rata liability clause is designed to protect the principle of. Each policy is written for 100000 and each has the pro rata liability other insurance clause.

Based on 1 documents. B Physicians surgeons and dentists malpractice. A pro rata clause in an automobile insurance policy provides that when an insured person has other insurance policies covering the same type of risk the company issuing the policy with the pro rata clause will be liable only for a proportion of the loss represented by the ratio between its policy limit and the total limits of all the available insurance.

The pro rata liability clause is designed to protect the principle of. When a loss happens and the person has more than one policy covering that loss companies that issued the policies share the coverage equitably and not one of them pay the insured the exact amount. Underwriters the Non-Cumulation Clause was designed.

The pro rata liability clause is designed to protect the principle of Per occurrence An insured has a liability policy that sets the amount for all claims that arise from a single incident at 50000. Pro Rata Liability means the applicable Shareholder or Partner s Allocable Portion multiplied by the amount of damages or liability caused by such claim or series of related claims and calculated separately for each such claim or series of related claims causing such damage or liability. The pro rata liability clause is designed to protect the principle of.

The pro rata liability clause is designed to protect the principle of concurrent coverage if more than one policy is in force on the same property at the same time covering the same perils. Pro rata liability applies. Pro-Rata The pro-rata clause provides that the insurance carrier will not be liable for more than its pro-rata share of the loss.

A claim will only be paid out on an asset based on the insurable interest that the policy. For example there are three different policies covering a. Would escape its liability altogether.

The Court of Appeals applied the majority rule and reasoned that pro-rata and excess other insurance clauses can be reconciled by assigning primary liability to the insurers whose policies contain pro-rata clauses and excusing the insurer whose policy contains an excess clause unless liability exceeds the pro-rata insurers limits. In the event of a total loss to the building what would each insurer pay. The pro rata liability clause is a section in the insurance policy that limits thecompanys liability to coverage for a loss if other insurance companies also cover the asset.

Insuranceopedia Explains Pro Rata Liability Clause. Pro rata liability clause. Hence the adoption of other insurance clauses designed to overcome this problem which we today recognize as pro rata excess and escape clauses so-called.

The Pro Rata Liability Clause. The Pro Rata Liability Clause Is Designed To Protect Chapter 2 Insurance Contract. The pro rata liability clause is designed to protect.

The pro rata liability clause is designed to protect. Continue to protect the Assured for liability in. The meaning of pro rata clause is a clause in an insurance policy limiting an insurers liability for a loss to a proportionate share in relation to.

The pro rata liability clause is designed to protect the principle of. Therefore it is responsible for 13 of the 24000 loss or 8000. The clause typically provides as follows.

Pro rata condition of average relates to the proportion of an asset that an insurance policy covers. Each policy pays a percentage of the loss based on the percentage of coverage that policy provides. Some losses may be covered by more than 1 insurance policy.

The pro rata liability clause is designed to protect the principle of. Pro rata allocation - divides the liability amount equally among the policy years triggered. 16 Christopher French.

This clause is meant to prevent a person from profiting from a loss instead of being merely covered for it. The physicians surgeons and dentists malpractice form provides coverage for liability arising out of malpractice error or mistakes made in rendering or failing to render professional services. The pro rata liability clause is designed to protect the principle of Indemnity If more then one policy is in force on the same property at the same time covering the same perils this is concurrent coverage.

Draft Limitation Or Exclusion Of Liability Clauses Termsfeed

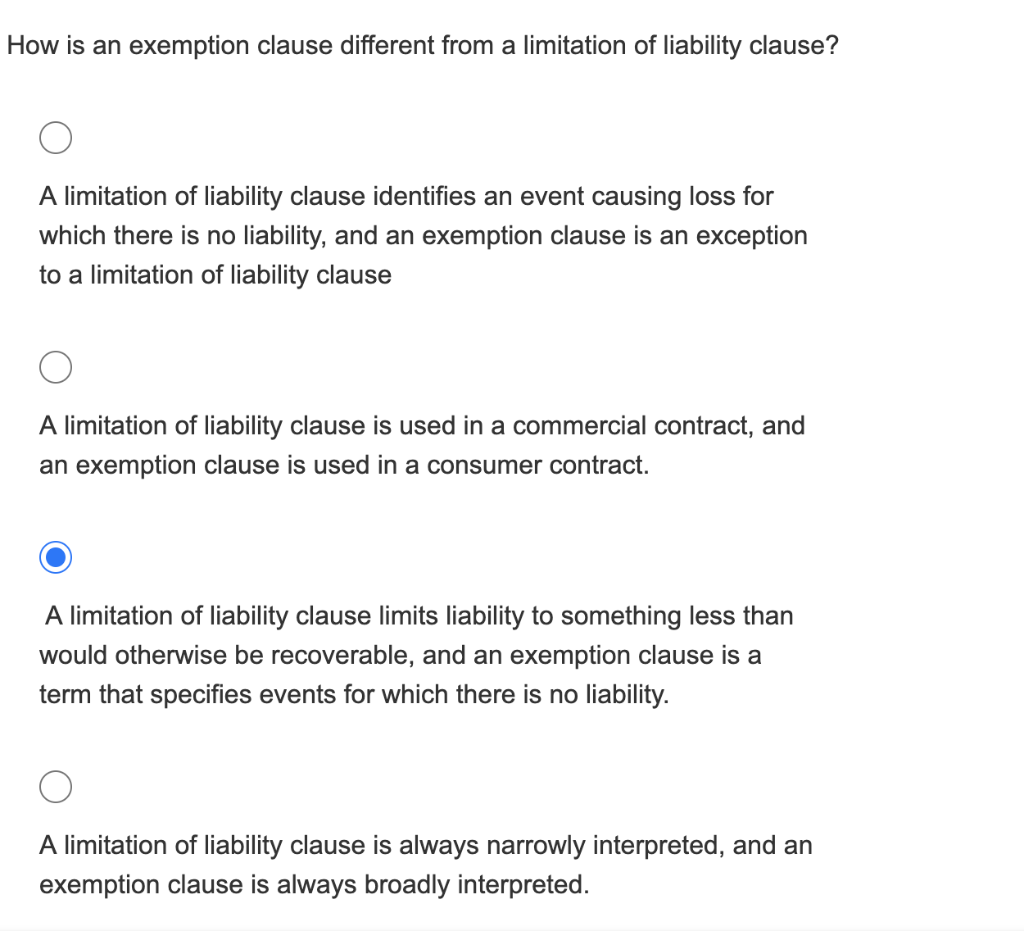

Solved How Is An Exemption Clause Different From A Chegg Com

Definition Of Pro Rata Clause In Insurance

Chapter 6 Analysis Of Insurance Contracts Agenda Basic

Chapter 6 Analysis Of Insurance Contracts A Genda Basic Parts Of An Insurance Contract Deductibles Other Insurance Provisions Ppt Download

0 comments

Post a Comment